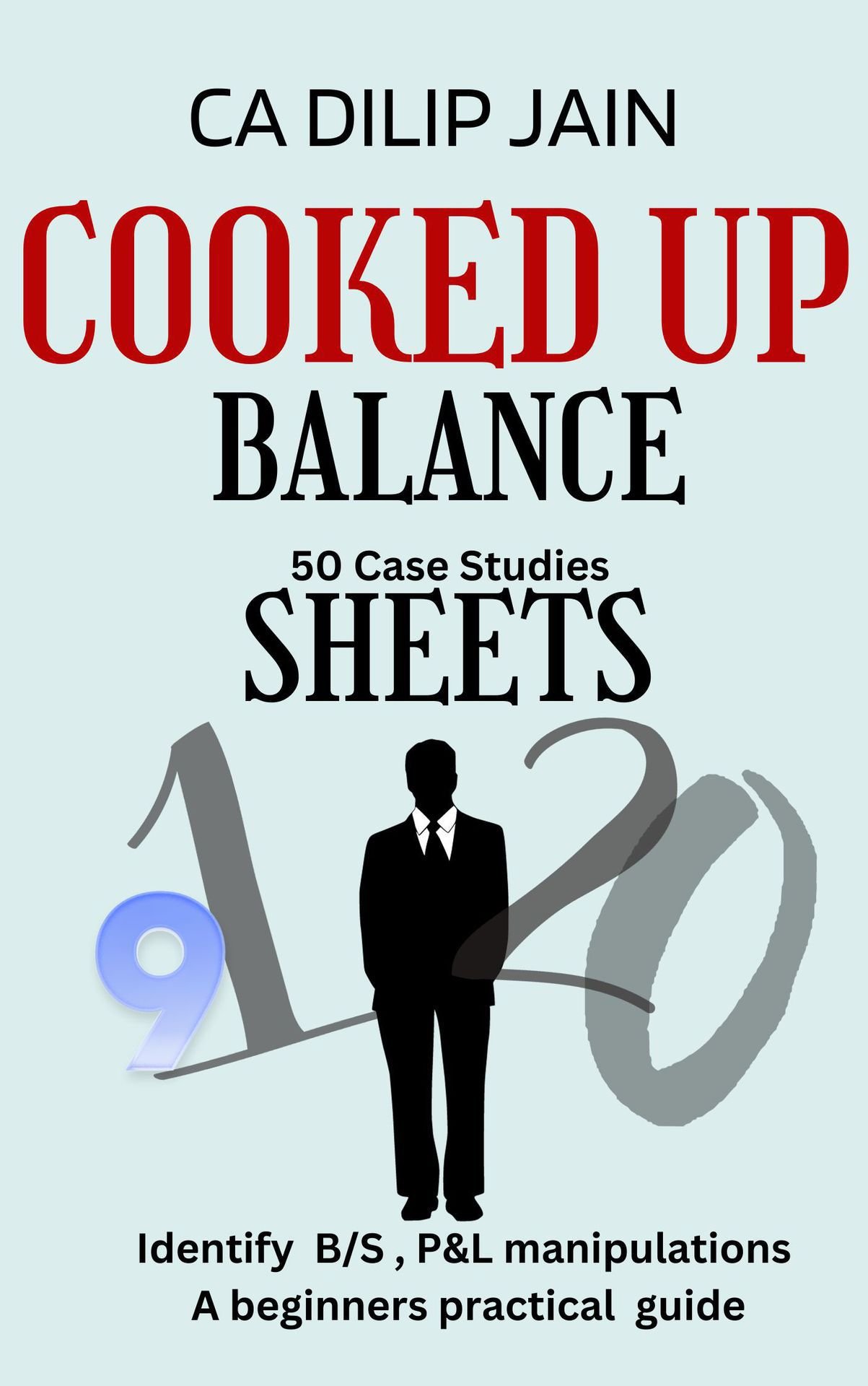

In an era where financial complexities often mask the true nature of corporate activities, the need for transparency and ethical conduct has never been greater. The objective of this book is twofold: to empower even those without a financial background to understand the misuse of balance sheets for various vested interests, and to serve as a guide for professionals on how to identify frauds in financial statements and plan mitigation measures.

Features of the Book

Educational Case Studies: The book contains 50 meticulously crafted case studies that span various industries and types of businesses. Each case study is followed by a detailed analysis that explains how to identify the financial manipulations and what could be the potential implications, such as money laundering or tax evasion.

IFRS Standard Presentation: All financial statements in the case studies are presented as per the International Financial Reporting Standards (IFRS), making them universally applicable.

Notes and Disclosures: To provide a comprehensive understanding, relevant extracts of notes to accounts and any disclosures are included.

Step-by-Step Solutions: Each case study is followed by a solution that not only identifies the fraudulent activity but also explains how it was identified, thereby serving as a practical guide for auditors and accountants.

Mitigation Strategies: The book offers actionable insights into how users of financial statements can mitigate risks associated with financial fraud.

1: XYZ Tech Corp.- Revenue Inflation & Related Party Transactions

2: Alpha Healthcare Inc.-: Asset Overstatement & Phantom Revenue

3: Beta Motors Inc. Inventory Manipulation & Cost Shifting

4: Delta Airlines Co. -: Unrealized Foreign Exchange Gains

5: Gamma Pharmaceuticals Inc.-: Manipulation of Depreciation and Amortization Expenses

6: Beta Electronics Ltd.-: Inventory Valuation Manipulation

7: Delta General Trading Co.-: Revenue Recognition Manipulation

8: Gamma Trading Co.-: Cash Handling and Revenue Skimming

9: Omega Real Estate Corp. -: Asset Inflation and Off-Balance Financing

10: Beta Retailers Inc. -: Inventory Manipulation and COGS Inflation

11: LocalBake Café -: Cash Inflow Manipulation and Revenue Overstatement

12: GreenTech Energy Solutions-: Asset Overvaluation and Depreciation Manipulation

13: AgroTrade Co.-: Inventory Inflation and Trade Payables Manipulation

14: QuickFix Auto Repairs-: Revenue Inflation and Expense Underreporting

15: Elite Art Gallery-: Unaccounted Money Infiltration and Loan Manipulation

16: Green Energy Solutions-: Asset Overvaluation and Liability Underreporting

17: OceanView Resorts-: Balance Sheet Manipulation

18: Skyline Aviation-: Revenue Recognition Manipulation

19: GreenLeaf Pharmaceuticals-: Overstating Expenses

20: OceanView Resorts -: Hidden Liabilities

….

31: GreenTech Energy Solutions – Off-Balance Sheet Financing and Deferred Tax Liabilities

32: OceanView Resorts – Inflated Asset Valuation and Understated Expenses

33: AutoMoto Inc. – Overstated Revenue and Hidden Liabilities

34: Cash Skimming and Unrecorded Sales

35: GreenTech Energy – Off-the-Books Financing and Inflated Asset Valuation

36: Global Trade Group – Inflated Investments and Offshore Transactions

….

40: Omega Pharmaceuticals – Concealing Contingent Liabilities and Off-Balance Sheet Financing

41: Delta Airlines – Revenue Smoothing and Cookie Jar Reserves

..

43: Stratagem Consulting Group – Inflated Intangible Assets

44: TerraHoldings Inc. – A Holding Company Real Estate and Investments

45: FabriTrade Inc. – Textiles Trading with Unsecured Loans and Inflated Investments

….

49: SpiceWorld Inc. – Import and Export of Spices and Food Grains with Inflated Revenue and Hidden Offshore Accounts

Sale!

AML, Books

Cooked up Balance Sheets: Case Studies How to Decode Them

Rated 5.00 out of 5 based on 1 customer rating

(1 customer review)

₹899.00 Original price was: ₹899.00.₹549.00Current price is: ₹549.00.

1 review for Cooked up Balance Sheets: Case Studies How to Decode Them

Add a review Cancel reply

Related products

-

AML

AML GYM- CASE STUDIES

Rated 0 out of 5₹1,599.00Original price was: ₹1,599.00.₹1,299.00Current price is: ₹1,299.00. Add to basket -

AML

AML BRAIN GYM-DBFBPs: Focus Series on real estate, precious metals, Auditors and Legal Persons

Rated 5.00 out of 5₹1,499.00Original price was: ₹1,499.00.₹1,199.00Current price is: ₹1,199.00. Add to basket -

Books

360 Compliance for beginners

Rated 5.00 out of 5₹1,499.00Original price was: ₹1,499.00.₹999.00Current price is: ₹999.00. Add to basket -

AML

Biz bytes- know your customer’s business

Rated 5.00 out of 5₹999.00Original price was: ₹999.00.₹799.00Current price is: ₹799.00. Add to basket

Michael Johnson –

“Cooked Up Balance Sheets” is a fascinating dive into the world of financial manipulation and its implications. The book is brilliantly written, engaging readers with compelling case studies and insightful analysis. It not only educates us on the techniques used to distort financial statements but also on the ethical considerations and the importance of transparency. An essential read for finance students and professionals alike.